Our Key Programmes

Comprehensive financial solutions to meet the needs of exporters, importers, and businesses looking to expand globally.

Financing India's Exports

-

` Lines of Credit

-

` Buyer's Credit

-

` Pre-shipment Credit

-

` Post-shipment Credit

-

` Guarantees and LCs

Enhancing India's Export Competitiveness

-

` Term Loans

-

` Export Product Development

-

` Export Facilitation

-

` Overseas Investment Finance

-

` Import Finance

-

` Guarantees and LCs

-

` Sustainable Finance Programme

Supporting MSME Exports

-

` Ubharte Sitaare Programme

-

` Trade Assistance Programme

-

` Export Factoring

Promotional & Developmental Initiatives

-

` Grassroots Initiatives for Development

-

` Marketing Advisory Services

-

` Research & Analysis

Trusted by global businesses

Total Loan Book

Countries Covered

Total Business Volume

Years of Experience

Coming Soon

News & Updates

Stay informed about our latest initiatives, market insights, and developments in global trade.

July 10, 2025

Exim Bank's study highlights the immense..

Exim Bank's study titled “Strengthening India-Brazil Economic..

July 8, 2025

India Exim Bank Announces the Winner of the BRICS..

India Exim Bank's BRICS Economic Research ...

June 26, 2025

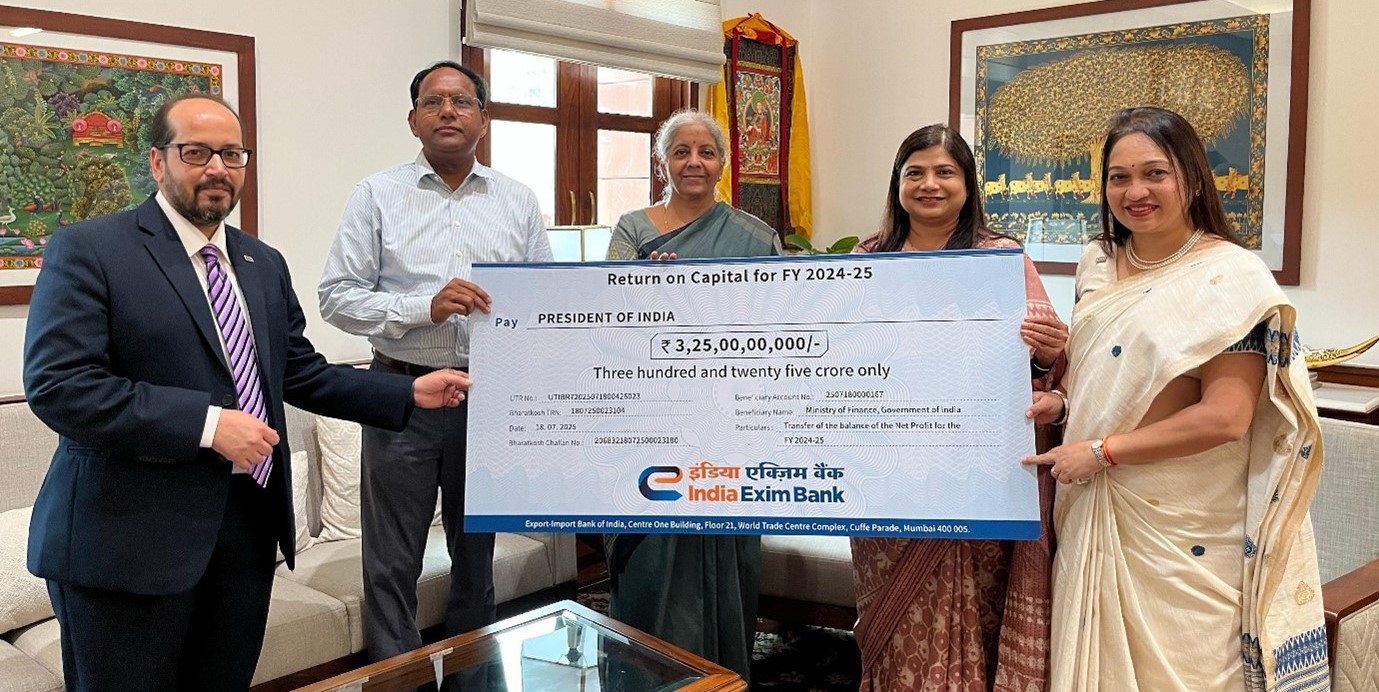

Hon'ble Finance Minister Highlights Key...

Smt. Nirmala Sitharaman, Hon'ble Minister..

Publication

Stay informed about our latest initiatives, market insights, and developments in global trade.

Ready to take your business global?

Connect with our team of experts to explore tailored financial solutions and advisory services for your international business needs.