Press Releases

India Exim Bank forecasts India’s merchandise exports to amount to US$ 125.3 bn and Non-oil exports to US$ 113.4 bn for Q4 (January-March) of FY2026

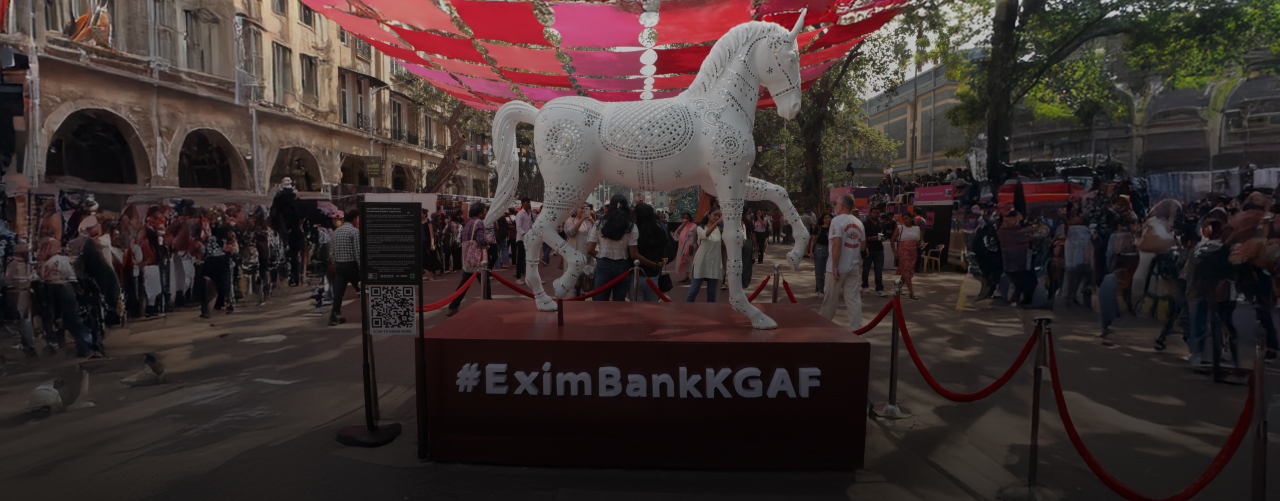

India Exim Bank & Kala Ghoda Arts Festival join forces to celebrate a vibrant intersection of art and culture More than 60 artisans from 20 states, nurtured by India Exim Bank, to participate in the Festival

Cluster‑Focused Strategy Can Propel India’s Gems & Jewellery Exports to US$ 75 Billion by 2030: Exim Bank and GJEPC’s Joint Study

India Exim Bank Creates History with US$ 1 Billion Dual-Tranche Bond Issuance

Exim Bank Announces the Winner of IERA Citation 2024

Secretary, DFS Highlights New Credit Guarantee Scheme for Exporters at India Exim Bank Seminar in Kochi

EDB–India Exim Bank Webinar Highlights Natural Synergy and Trade Finance Potential in India–Central Asia Economic Cooperation

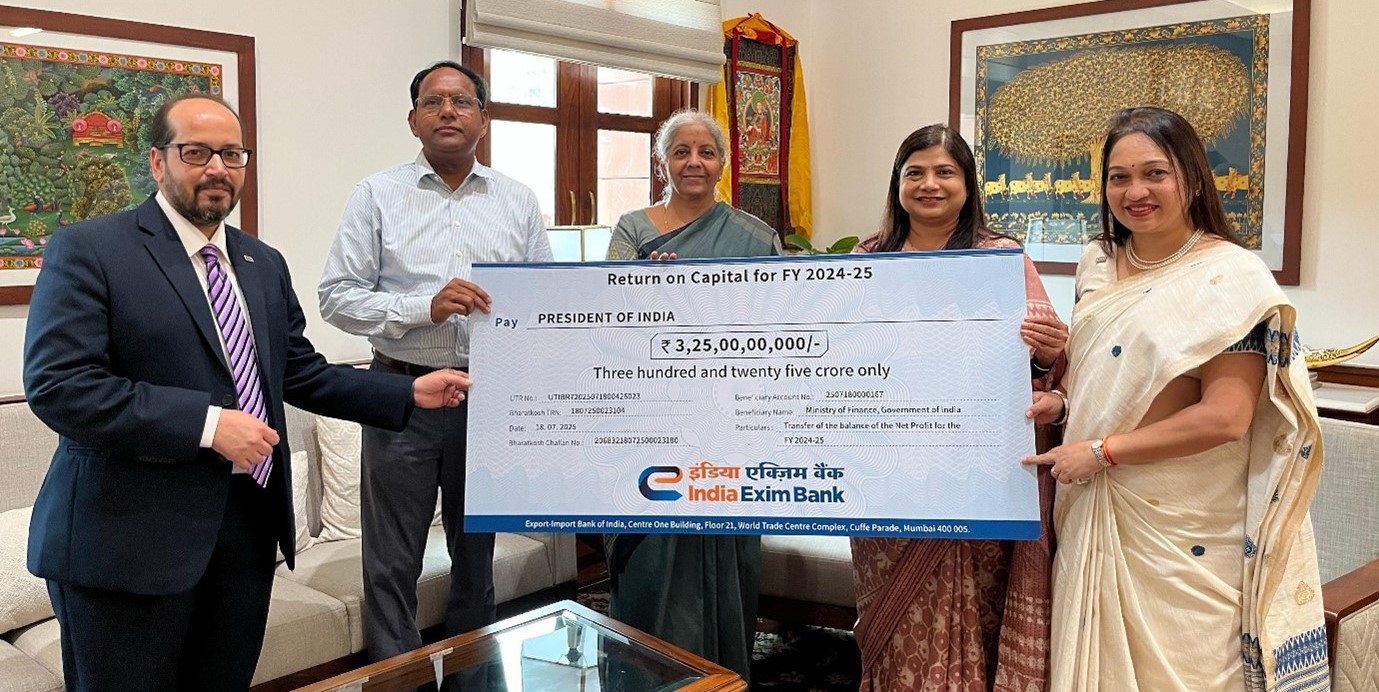

Exim Bank transfers ₹ 325 crore balance of net profit to GoI

Exim Bank’s study highlights the immense opportunities for increasing bilateral economic cooperation between India and Brazil